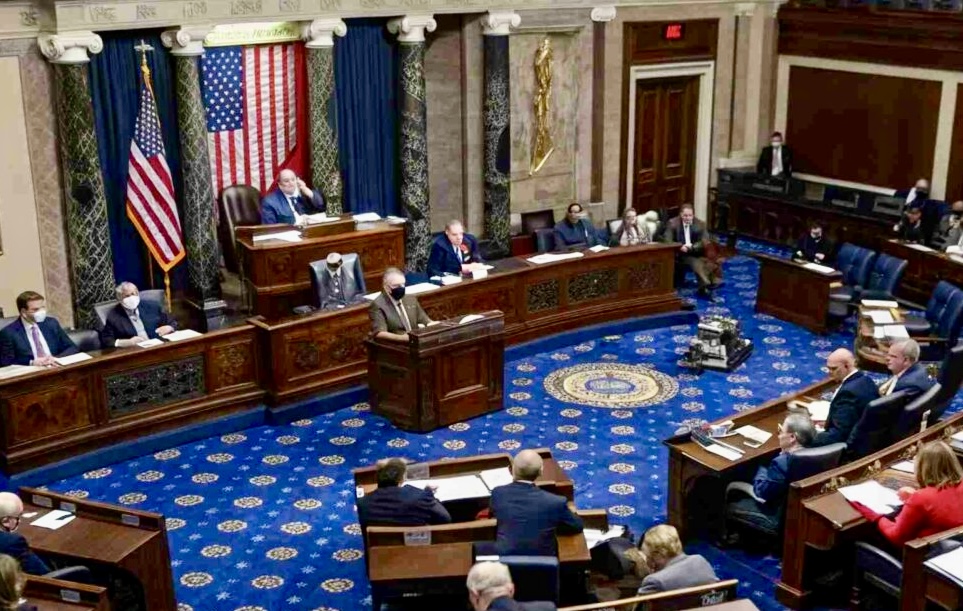

In a landmark move for the cryptocurrency industry, the U.S. House of Representatives officially passed the “Genius Act” (Stablecoin Transparency and Accountability Act of 2025) earlier today, as reported by WatcherGuru on X at 19:38 UTC. This legislation marks a pivotal step toward regulating stablecoins, potentially reshaping the future of digital finance in the United States. With the bill now advancing, it signals a broader acceptance of crypto within the traditional financial system, though it comes with significant implications for innovation, sovereignty, and market dynamics.

What is the GENIUS Act?

The GENIUS Act, formally known as S. 919, establishes a federal framework for stablecoins—cryptocurrencies designed to maintain a stable value, typically pegged 1:1 to the U.S. dollar. The bill requires issuers to obtain federal licenses, maintain full reserves to back their tokens, adhere to strict safety and transparency standards, and ensure interoperability across platforms. This legislation, which has been in development for over a year, aims to foster innovation while protecting consumers and the broader economy from the risks posed by unregulated digital assets.

The bill’s passage follows months of debate, with a procedural victory cleared just yesterday, July 16, after President Donald Trump intervened to push the initiative forward, according to Reuters. The Senate had already approved a version of the bill earlier this year, and with House approval today, it now heads to the President’s desk for signature, likely cementing it as the first federal crypto law in U.S. history.

Why It Matters

Stablecoins like Tether (USDT) and USD Coin (USDC) have become cornerstones of the crypto ecosystem, facilitating faster and cheaper transactions compared to traditional banking systems. With a combined market capitalization exceeding $200 billion in mid-2025 (per CoinMarketCap data), their growth underscores their importance. The GENIUS Act responds to this surge by bringing these assets under a regulated umbrella, addressing concerns over reserve transparency and systemic risks that emerged during past market volatility.

For the crypto community, this is both a victory and a double-edged sword. On one hand, regulatory clarity could attract institutional investors, deepen liquidity, and integrate stablecoins into the mainstream financial infrastructure. On the other, the imposition of Know Your Customer (KYC), Anti-Money Laundering (AML) requirements, and audit trails signals a shift toward centralized oversight, potentially diluting the decentralized ethos that defines crypto.

Broader Implications

Analysts on X and beyond suggest the GENIUS Act is more than just a stablecoin regulation—it’s a strategic move to reassert U.S. dollar dominance in the digital age. By sanctioning stablecoins under a federal framework, the U.S. aims to extend its monetary influence onto blockchain networks, countering the rise of global competitors and decentralized finance (DeFi) platforms. This aligns with recent data showing a 15% growth in stablecoin market cap in Q2 2025, driven by increased adoption in DeFi and cross-border payments.

The bill also sets the stage for a convergence of traditional finance (TradFi) and DeFi. While it opens the door for institutional capital, it introduces a “walled-garden” DeFi model—permissioned yet capital-rich—complete with surveillance layers. This could accelerate innovation but may also limit the anarchic freedom that early crypto adopters cherished.

Market Reactions and Future Outlook

The X thread following WatcherGuru’s announcement reflects a mix of excitement and skepticism. Enthusiasts predict a bullish market response, with calls for assets like Solana (SOL) and XRP to hit new all-time highs, fueled by optimism around DeFi growth. However, some users, like @bigdami_1, raised concerns about the dollar peg’s vulnerability to future quantitative easing, a valid point given the Federal Reserve’s historical monetary policies.

Technical analysis from platforms like Changelly suggests Solana could reach $364 by next year, buoyed by network upgrades and market sentiment, though short-term dips are possible. For stablecoin holders, the immediate impact may be a revaluation of legitimacy, as the GENIUS Act redefines the boundary between “real money” and “magic internet tokens.”

Conclusion

The passage of the GENIUS Act is a watershed moment, marking the U.S.’s formal entry into the on-chain economy. It balances innovation with regulation, secures dollar supremacy, and sets a precedent for global crypto policy. Yet, it also raises questions about sovereignty and the long-term vision of a decentralized financial future. As capital follows the flag, the crypto community must navigate this new landscape—bags up, but with eyes wide open.

For the latest updates, check https://www.congress.gov/bill/119th-congress/senate-bill/919 or follow the evolving conversation on X. The digital dollar’s future begins here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risks, and readers should conduct their own research or consult a professional advisor.